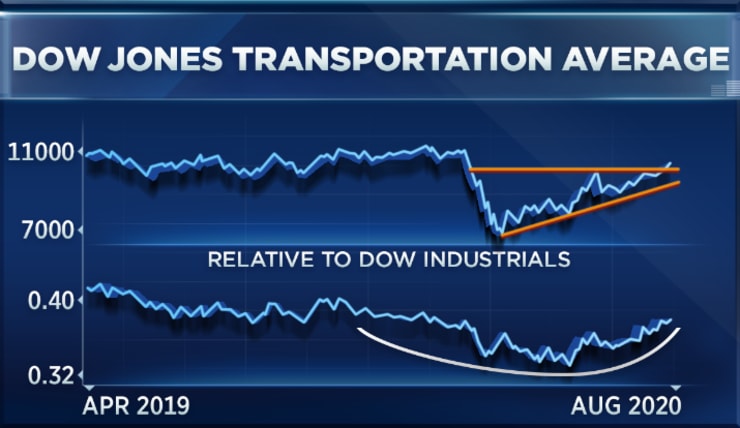

Dow theory … with a twist.

That’s what this year’s market uncertainty could bring, Chantico Global founder and CEO Gina Sanchez told CNBC’s “Trading Nation” on Friday as the Dow Jones Transportation Average overtook its June highs.

According to Dow theory, developed in the late 1800s by Charles Dow himself, when one of the Dow’s underlying averages — industrials or, in this case, transportation — breaks above a noteworthy previous high, the broader Dow is likely to follow.

But this year’s market layout could be a major obstacle for that usually reliable indicator, Sanchez said.

“It’s messy this year because the Dow theory assumes that those gains are going to be spread across the economy fairly equally and that isn’t the case,” she said.

While there’s a lot of talk out there about the potential for a V-shaped recovery in the stock market, Sanchez said a K-shaped recovery, in which only parts of the economy are able to recover successfully, is also in the cards.

“If that’s the case, the Dow theory is only going to help the parts of the economy that are still participating in the economy,” she said.

The very nature of the market’s major averages paints a fairly stark picture of likely winners and losers, especially considering their year-to-date performance, she added.

The Dow, for one, is “sort of old economy, more cyclical, more value names,” Sanchez said. “You look at the Nadsaq, which has had a roaring year — that’s very growthy names. I’m actually not sure that we’re going to rotate back into those kind of cyclical, underbought names until we see more signs of a solid recovery, which probably aren’t going to come until not just when we get a vaccine, but when that vaccine is broadly distributed, which is probably well into 2021.”

JC O’Hara, chief market technician at MKM Partners, offered a counterpoint on why Dow theory may hold up better than expected in this environment.

“Many investors watch the transportation averages, and that gives you a pretty good barometer into the state of the U.S. economy and, in today’s world, the global economy,” he said in the same “Trading Nation” interview.

When the Dow’s transportation and industrial averages were first created, the thought process was simple, O’Hara said: “The industrial sector makes stuff. The transportation sector is responsible for shipping that stuff to meet consumer demand.”

“In today’s world, we’re seeing that hold true as well,” he said. “We’re seeing the industrial sector acting well. We’re seeing the transportation sector actually beginning to outperform because they’re actually delivering the stuff to meet consumer demand.”

o far, that strength suggests Dow theory is still in play, O’Hara said, referencing a chart showing the Dow’s transportation and industrial stocks moving higher in tandem.

“We would become concerned if we started to see the industrial sector make new highs, but [the] transportation sector rolling over and making new lows,” he said. “That would be a divergence, and historically, that has been a sign of a top formation. But we are not seeing that now.”

The Dow and S&P 500 notched their sixth straight day of gains on Friday. The Dow Jones Transportation Average climbed more than 2%, helped by rises in the shares of FedEx and UPS, which closed up 6.5% and nearly 8%, respectively. UPS hit a new all-time high.

Analysts at Stephens named Fedex’s stock as their “best idea” in a Friday note and flagged 10 potential upside catalysts for the shares including the company’s pricing power, a pickup in business-to-business spending and the eventual launch of Walmart+.

O’Hara and Sanchez agreed that there was value in FedEx. O’Hara also noted the stock’s momentum — FedEx is up sharply from its mid-March lows.

“There’s a lot of value, actually, locked up in a lot of names,” Sanchez said of the overall market.

“The question is what catalyzes that value to be unlocked? And that’s really where I think the fly is in the ointment here,” she said. “You have to believe that you’re going to see a significant pickup in the fall, or even that we’re seeing it now and it’s going to translate to earnings fairly quickly. I’m not sure we’re there yet. I think there’s value, it’s just a matter of when.”

Story by :