Emerging markets have found new life.

The EEM emerging markets ETF has snapped back after finding a bottom late last month with some markets like Turkey, Brazil and Indonesia surging by double digits.

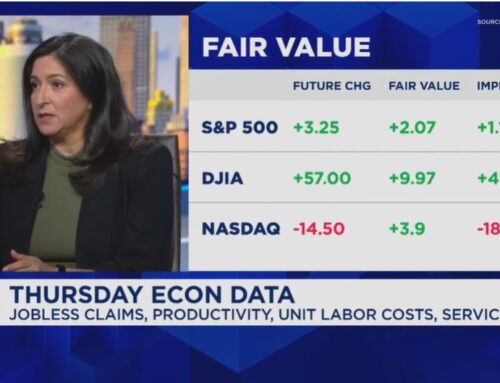

Their strength comes as U.S. stocks tumble. Over the past two weeks, the S&P 500 has dropped nearly 4 percent and the Dow has shed around 1,350 points.

Ari Wald, head of technical analysis at Oppenheimer, does not expect emerging markets to continue to outperform U.S. stocks for much longer.

“We have seen the S&P underperform since the start of the fourth quarter,” Wald said Monday on CNBC’s “Trading Nation. ” However, “what’s telling for us is that this weakness is still occurring within an uptrend as indicated by that rising 200-day moving average, that the longer-term trend is still pointing toward the U.S.”

The S&P 500 has steadily outperformed the EEM ETF since April. Their relative 200-day moving average has been on the rise since that bottom.

“We generally define pullbacks against a rising 200-day moving average as near-term opportunities to buy long-term strength,” Wald added. “The recent underperformance in the U.S. is more the opportunity to stay overweight the U.S. and re-up on that call.”

Emerging markets got a bump on Monday after Morgan Stanley gave a two-notch upgrade to overweight. Gina Sanchez, CEO of Chantico Global, says Morgan Stanley’s bet on emerging markets makes sense as a long-term play.

“The upside is still there,” Sanchez said on “Trading Nation” on Monday. “Emerging markets are still the fastest-growing segment of the economic world, and they will continue to be. In fact, they’re not expected to peak until well after 2020, whereas the U.S. is probably already peaking now and will start to slow in 2019.”

However, a cloudy near-term outlook for emerging markets could still put pressure on the group, says Sanchez.

“This issue with what happens with China and the trade war is still an overarching issue that we still don’t really know the end of because that could turn into a currency war, that could turn into a lot of other things that we’re still unsure of at the moment,” said Sanchez.

Fears over an escalating trade war with China rose again on Monday after President Donald Trump told The Wall Street Journal that he expected an increase on tariffs to go forward as planned. The U.S. expects to impose 25 percent tariffs on $200 billion worth of Chinese goods on Jan. 1, up from the current 10 percent rate.