It’s a big week for Big Tech.

The CEOs of Apple, Amazon, Alphabet and Facebook testified Wednesday at a House Judiciary subcommittee hearing on antitrust, a day before the four companies are scheduled to report earnings.

Shares of all four tech titans closed higher Wednesday, with Amazon, Alphabet and Facebook climbing about 1% and Apple rising nearly 2%.

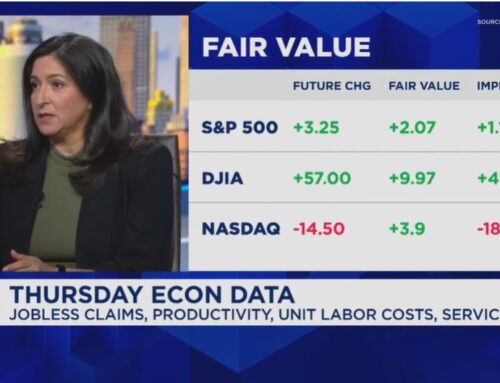

There are, however, looming risks to the growth story, Gina Sanchez, founder and CEO of Chantico Global, told CNBC’s “Trading Nation” on Wednesday.

Although there are few negatives in Amazon’s overall story save for the hearing, “it is trading at very, very, very high multiples,” Sanchez said. “Investors are starting to rethink the prices that they’re paying for some of these stocks.”

That’s because, based on the data, “these companies are overvalued no matter how you use them,” Sanchez said.

“You cannot pay an unlimited price for them,” she said. “There are better offerings out there in the stock market.”

If nationwide reopenings prove unsuccessful and cloud the outlook for the U.S. economy and these four giants, which account for nearly 16% of the S&P 500, the overvaluation will likely put a strain on the stocks, the CEO said.

“Being willing to pay exorbitant prices for these companies only works if it’s a short-term issue,” Sanchez said. “If it becomes a longer, more protracted downturn, then you have to start thinking about where to put your money.”

Delano Saporu, founder and financial advisor at New Street Advisors Group, liked Apple and Amazon the most out of the Big Four.

“The way we’re playing it is we’re trying to ride out the hearing and the earnings,” he said in the same “Trading Nation” interview.

“There’s no denying some of the valuations we’ve seen in these tech names, but I think the market has priced in what these businesses do and the value they provide to shareholders, especially if you look at Amazon and how essential the business was during the pandemic in bringing products straight to door-fronts and alleviat[ing] someone going out during quarantine.”

As for the earnings, Saporu said Amazon’s plan to invest its expected $4 billion profit into coronavirus pandemic-related efforts is “somewhat priced into the market already.”

“Historically, Amazon’s a company that doesn’t look quarter to quarter. They look long term,” he said. “And that’s how we’re looking at our investment horizon in some of these tech names.”

Disclosure: New Street Advisors Group owns shares of Apple and Amazon.

Story by :

Lizzy Gurdus@LIZZYGURDUS