Disney shares are enjoying their best quarter since 2009.

The entertainment giant has rallied nearly 30% since April as investors look past the coronavirus pandemic to the company’s eventual rebound.

Tread carefully here, warns Matt Maley, chief market strategist at Miller Tabak.

“It’s very similar to what it saw in late March after its initial bounce after a big sell-off in the first quarter,” Maley said Thursday on CNBC’s “Trading Nation.” Just as then, he warns it could be getting overbought after its steep run. “It could pull back. You don’t want to be too aggressive up here.”

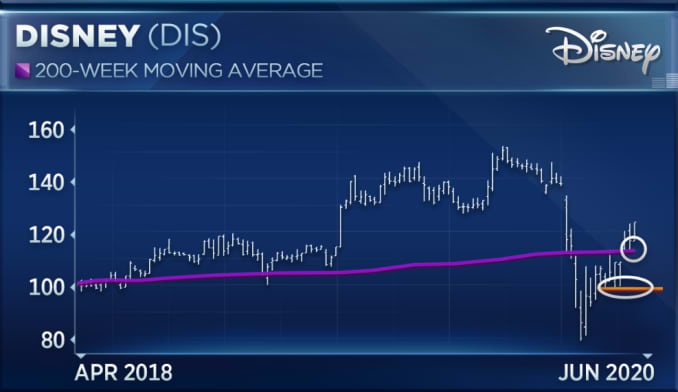

If it should hit a ceiling, Maley identifies two key levels that could provide opportunities to buy at lower levels.

“The 200-week moving average down at about $114. That’s provided excellent support for the stock, so that’s a level you want to get more aggressive,” he said. “If for some reason, the market gets hit and this gets thrown out — the baby gets thrown out with the bathwater — the $100 level, that’s provided great support back in May. That’s where you really want to back up the truck. So, be a little cautious up here, get aggressive at $114 and buy it with both hands if it gets anywhere near $100.”

Disney would need to fall 7% from current levels to reach $114. A decline to $100 marks nearly 20% downside.

Gina Sanchez, CEO of Chantico Global, says Disney looks solid as it reopens its theme parks worldwide. It received approval last week from the state of Florida to reopen its four Orlando-based theme parks starting July 11.

“If you look at parks, everything has shown that Disney has tremendous pricing power and tremendous brand value. Now obviously, they have a tremendous amount going against them,” she said in the same interview. “Quite frankly, the valuation is reflecting all of those positives, and so it’s not necessarily well valued. But its balance sheet is very good, it has good net interest coverage, it has access to debt, and it definitely is a survivor.”

Disney shares are one of the worst performers on the Dow this year, having fallen 15%. They remain 20% off November highs.

Story by Keris Lahiff